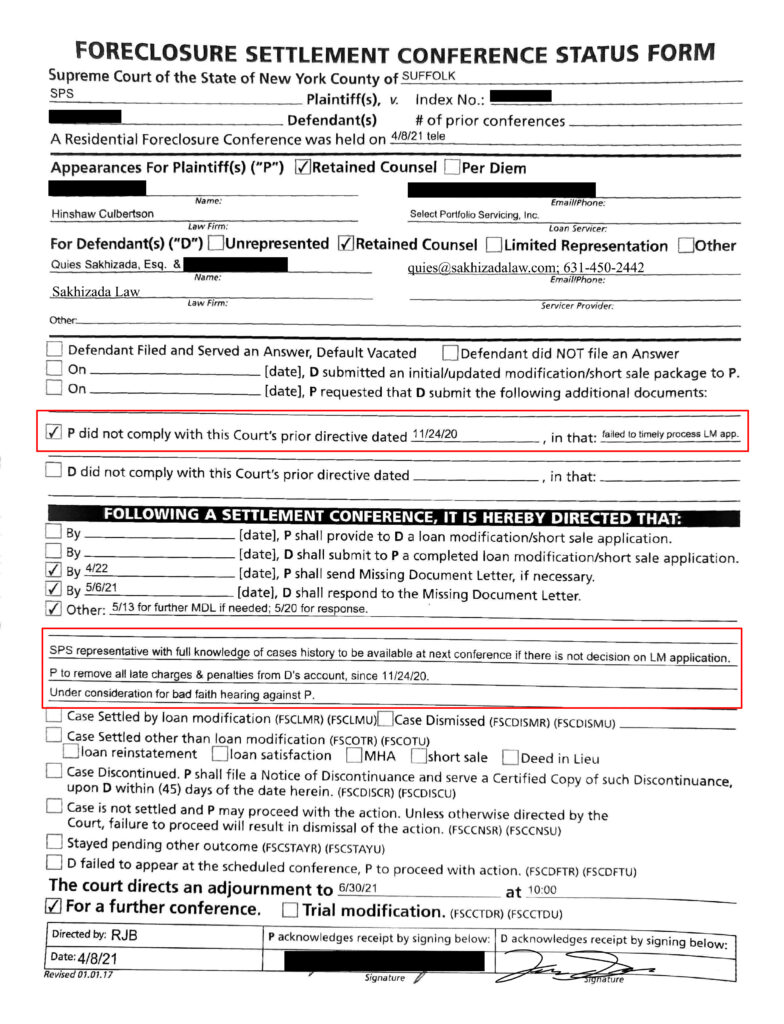

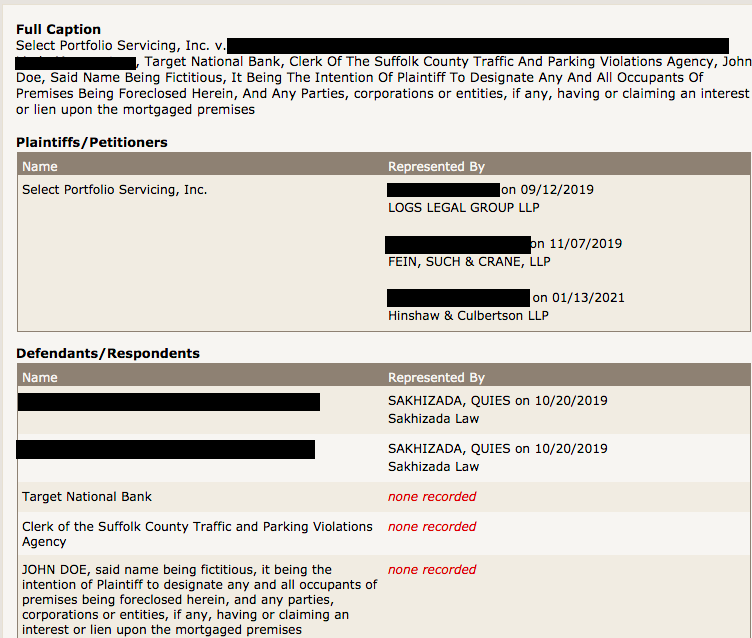

After numerous submissions, resubmissions, objections, settlements conferences, and recorded phone conversations with plaintiff (where the bank cannot clarify its own requests), my client and I were offered a bad faith hearing against a big bank and litigation firm on one of my Suffolk County cases. Out of sympathy for the newest attorneys on the case (since the commencement of the action, Select Portfolio Servicing has retained three separate law firms for representation), my client and I elected to give plaintiff one more opportunity at negotiating in “good faith.”

Pursuant to CPLR §3408, parties in a residential foreclosure action “shall negotiate in good faith to reach a mutual agreeable resolution….” Compliance with the statute is measured by the totality of the circumstances; notably, neither of the parties’ failure to make or accept an offer is sufficient to establish a failure to negotiate in good faith. A referee, judicial hearing officer, or other staff designated by the Court to oversee the settlement conference process may hear and report findings of fact and conclusions of law, and may make reports and recommendations for relief to the Court concerning any party’s failure to negotiate in good faith.

Upon a finding by the Court that a plaintiff failed to negotiate in good faith, the Court “shall, at minimum, toll the accumulation and collection of interest, costs, and fees during any undue delay caused by the plaintiff, and where appropriate, the Court may also impose…” civil penalties, damages, attorneys fees, and other relief deemed just and proper.

On this particular case, while we are prepared for litigation, we are giving SPS one more chance to get this right. My client and I expect the bank to waive interest, late charges, legal fees, and other charges in light of its own questionable practices, delays and miscommunications. If not, we will raise our issues before a judge.

When I first started my own practice, I was retained by a woman, whom previously retained several large NYC firms, to defend her in a Queens County foreclosure action. After a couple months of representing her, she described me as a “one man army” against a big plaintiff firm. I later got her case dismissed.

The truth is I do not care who is on the other side of the table or who my opposition is. I am fully confident in my legal skills and knowledge, and will represent my clients to the best of my ability. If my client has legitimate defenses and/or issues with a bank, I will make certain that my client’s claims are heard and received.

Who’s representing you?